Which is Better Fixed Deposit Or Mutual Fund?

The financial markets offer many investment options. However, the two most popular investments among Indians are FDs and mutual funds.

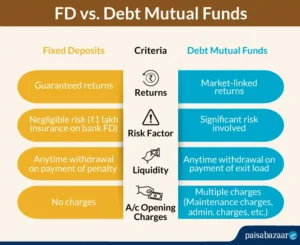

FDs provide guaranteed returns on the investment amount, while MFs are market-linked and may yield higher returns than FDs, depending on your risk appetite. So, which one should you choose?

Taxation

As financial markets become increasingly sophisticated, a wide range of investment products have emerged to serve the needs of investors. While both fixed deposits and mutual funds offer unique advantages, the type of vehicle that best fits your financial goals will depend on your risk tolerance and investment horizon.

A key difference between fixed deposits and mutual funds is taxation. FDs are completely tax-free investments, while mutual funds are subject to both short term capital gains (STCG) and long term capital gains (LTCG) taxes. STCG taxes are levied at a flat rate of 15%, while LTCG is taxed at 10% after indexation.

Moreover, the interest earned from fixed deposits is taxable under Section 10(24A) of the Income T